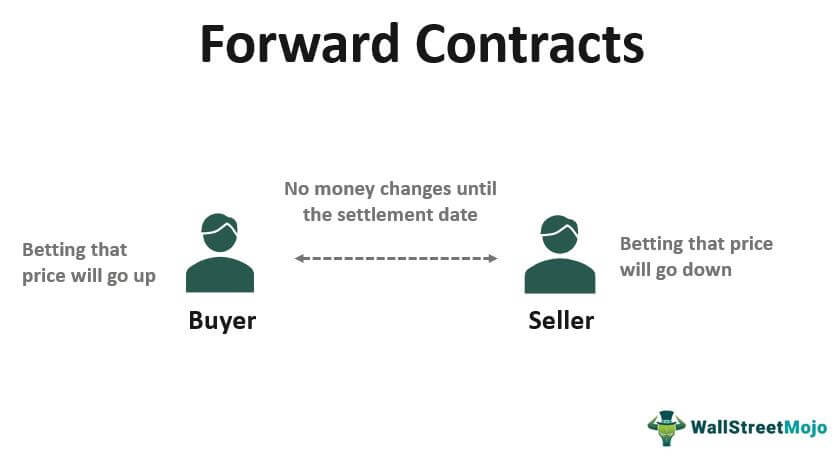

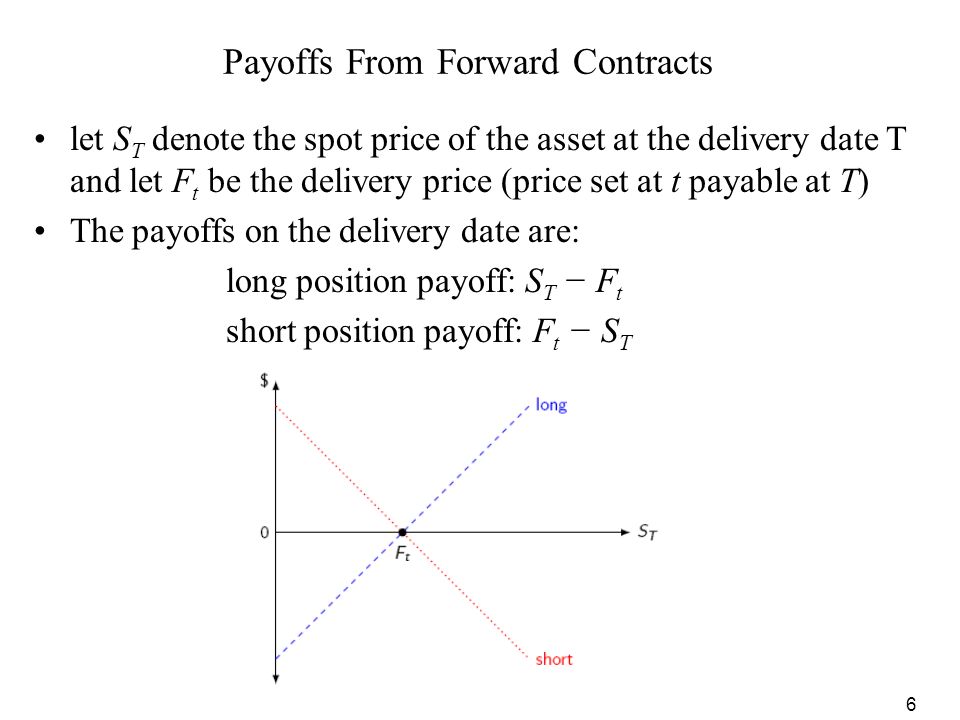

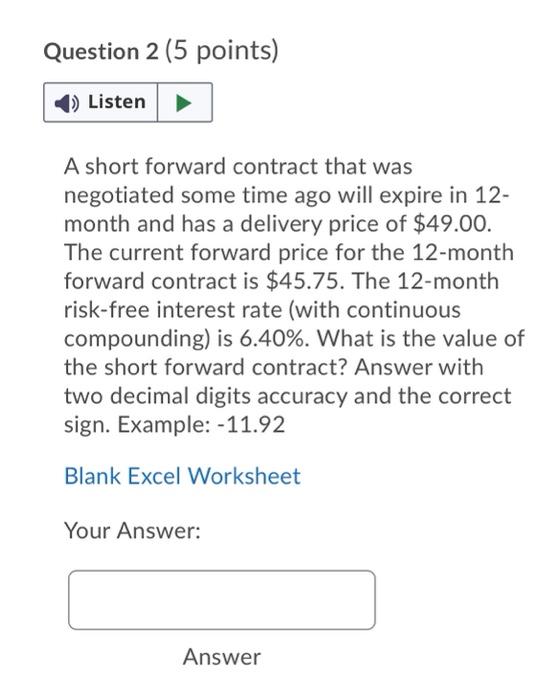

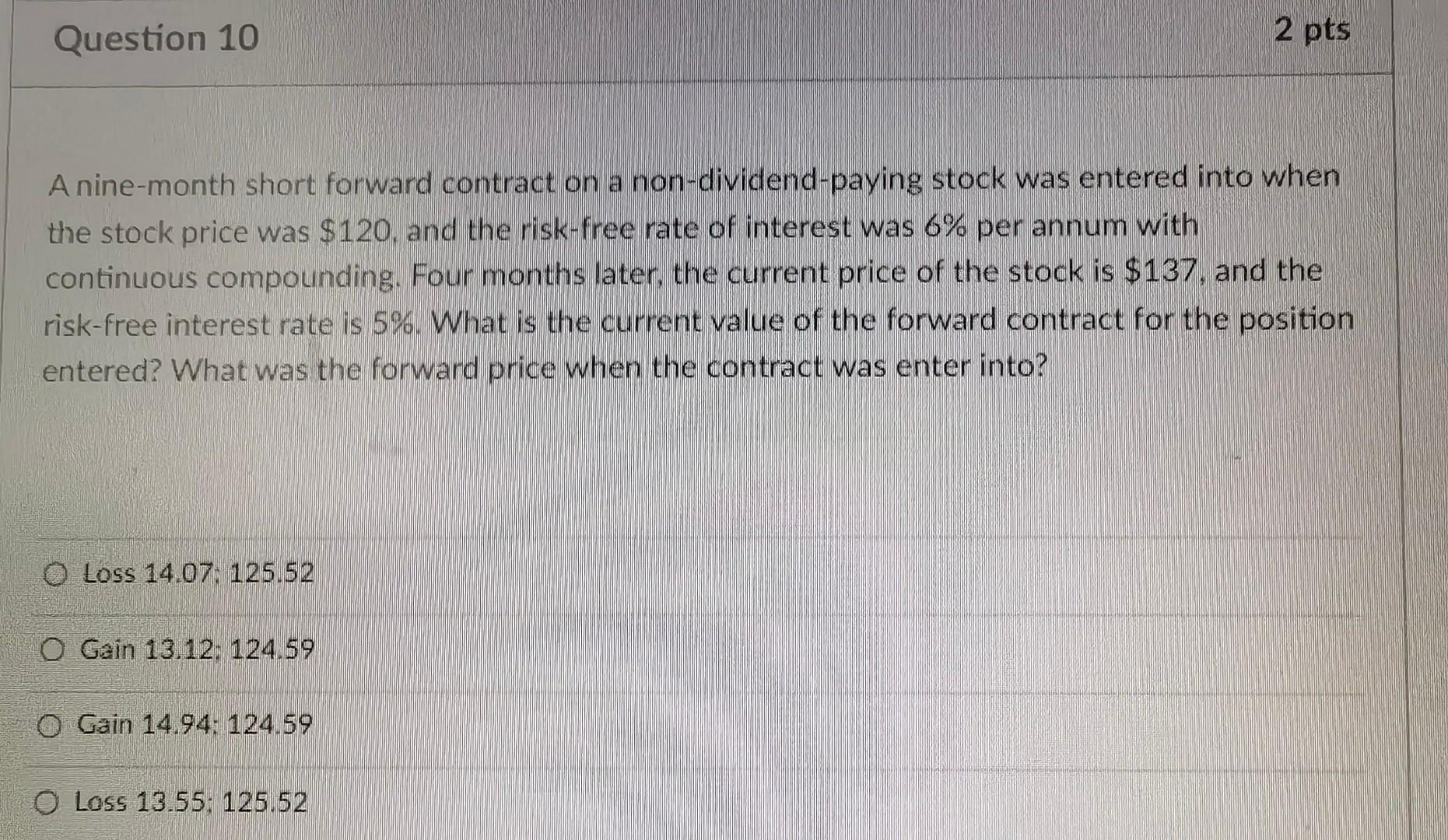

An off-market forward contract is a forward where either you have to pay a premium or you receive a premium for entering into the contract. (With a standard forward contract, the premium

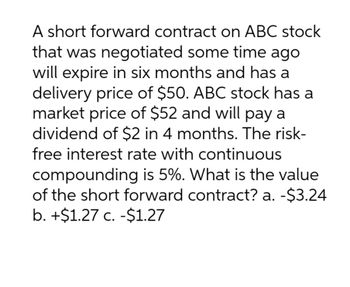

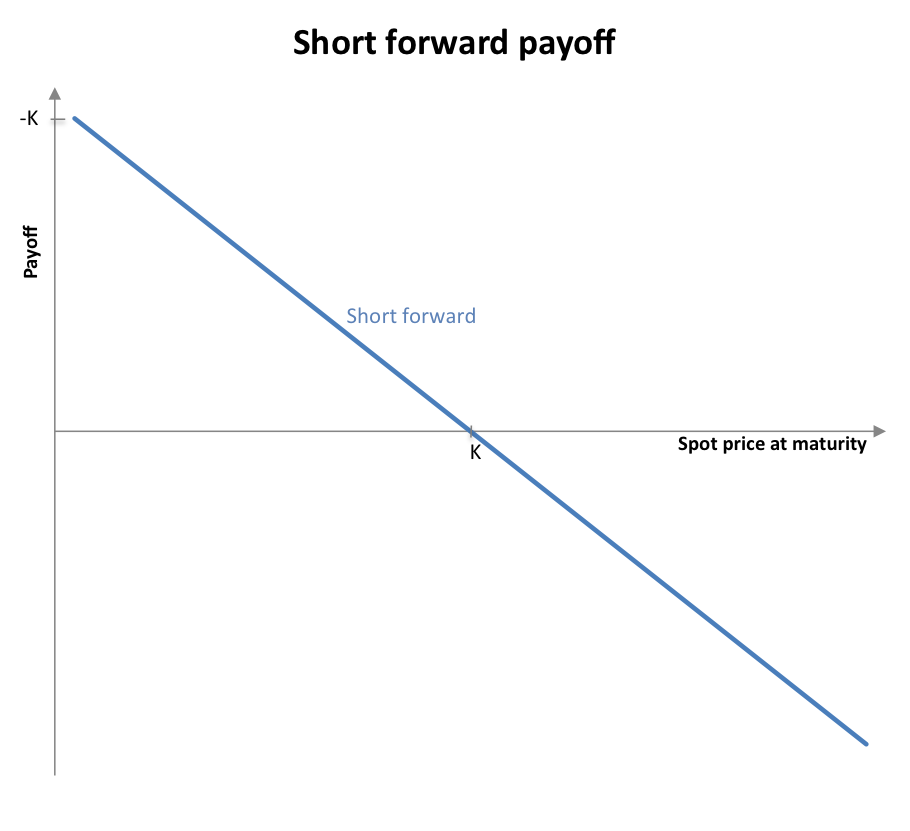

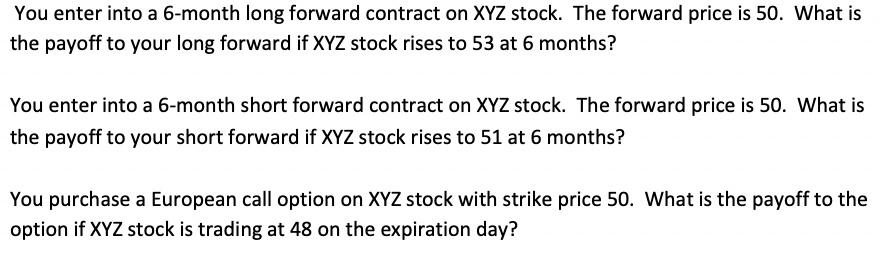

A trader enters into a short forward contract to deliver 340 shares of Amazon Inc. for $3,375 each. How much does the trader gain or lose if the share price of Amazon

no arbitrage theory - Simple value of a Forward contract at an intermediate time question - Quantitative Finance Stack Exchange

:max_bytes(150000):strip_icc()/ForwardContract_Final_4196098-a745f40c47f04d2fb8634295b4b8241b.jpg)

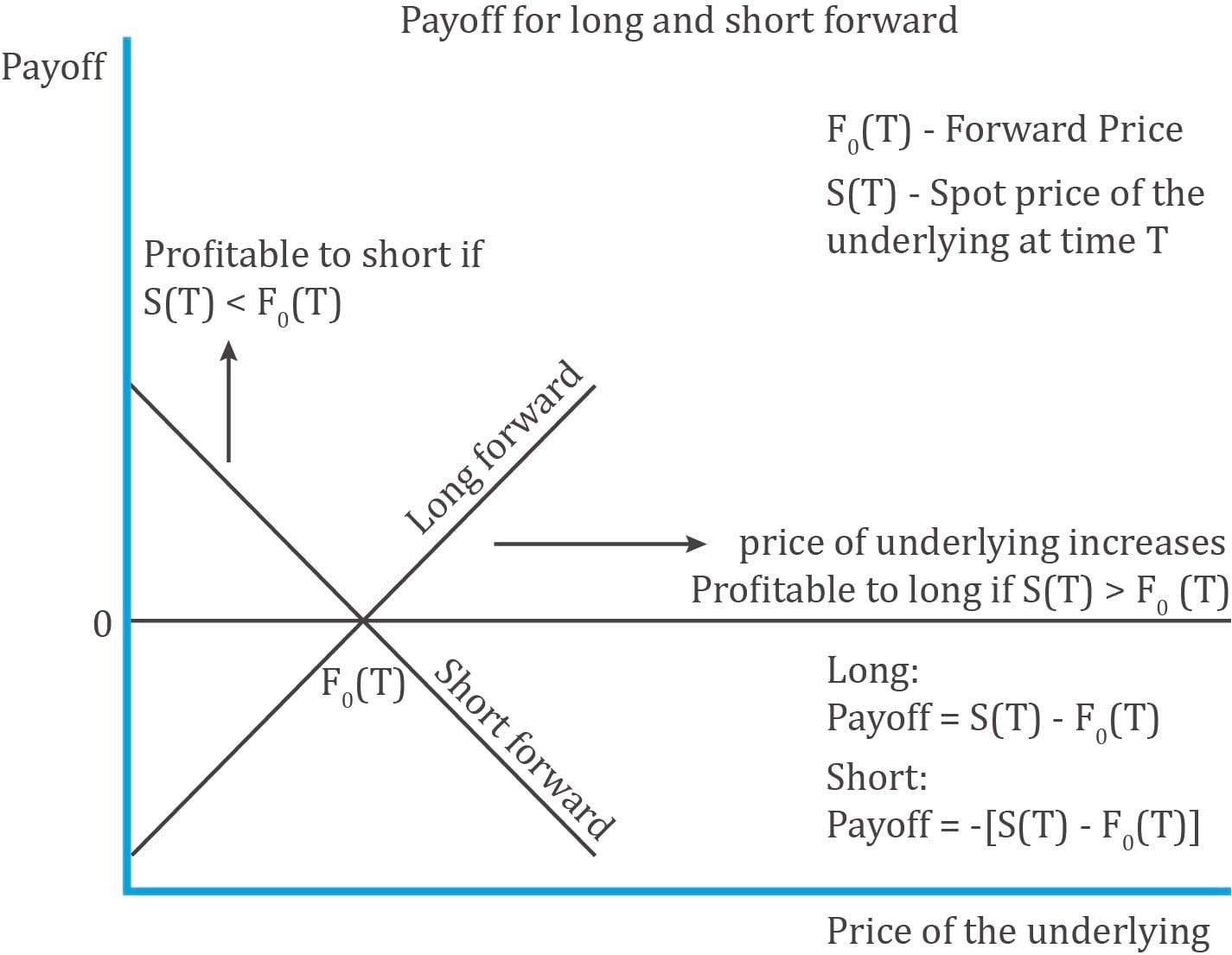

![PGP-I FM] Payoff diagrams – Back of the Envelope PGP-I FM] Payoff diagrams – Back of the Envelope](https://vineetv.files.wordpress.com/2013/10/payoff-diagram-forwards.png)